Buying or Leasing IT Equipment? Which Makes More Sense For Your Business

Deciding whether to lease or buy your equipment could be difficult. You must consider factors like budget, use cases, and estimated lifetimes for the devices you want to procure. Then, there are tax considerations.

While leasing involves lower initial costs, buying may be more profitable in the long term.

Ultimately, the decision rests between CapEx (capital expenditure) and OpEx (operating expenditure). Which of the two offers a better ROI and tax benefits? We understand the choice means walking a tightrope.

That’s why we weigh the pros and cons of buying and leasing office equipment to help you decide which is best for your business. Let’s get started.

TLDR;

- Leasing or buying equipment could be a tough decision for businesses, as they face challenges with predicting future needs or understanding what best suits their current cash flow.

- Leasing allows ownership of equipment at fixed intervals. While it has lower initial costs and efficiency, it can exceed the total cost of owning assets over time. Moreover, contract terms and conditions could prove to be a headache.

- Buying equipment involves a significant initial investment. It’s more suitable for well-established firms. It allows for greater customization of your equipment and keeps you more in control.

- Both leasing and buying allow tax deductions, and your accountant can best explain if OpEx(leasing) or CapEx(buying) is a better deal for your business.

- Workwize is a unified global IT hardware management platfrom to buy, rent, or lease laptops and other IT equipment or peripherals across 100+ countries. No need to negotiate, manage multiple vendors, or bear custom fees; Workwize does that for you!

Buy, rent, or lease laptops for your distributed teams across 100+ countries.

Workwize is a zero-touch platfrom for IT teams to procure, deploy, manage, retrieve and dispose of their IT hardware.

What Does It Mean To Lease Equipment

When you lease equipment, you sign a contract with a third-party service (the lessor) to use and own equipment for a predetermined period, say 3-5 years.

Leasing comes with a fixed monthly fee and sometimes even a slight interest fee. Once your lease expires, you either return the equipment or extend your lease.

According to an Equipment Leasing and Finance Association survey, around 80% of American companies use some form of financing, including leases, when acquiring equipment.

A CAGR of 2.1% is expected between 2022 and 2032 for the US rental and leasing market. This growth is due to increased employee headcount, hybrid and remote working environments, and the need for organizations to scale. Let’s look at the pros and cons of leasing equipment.

Pros of Leasing Equipment

1. Spending less upfront capital

Everyone from small enterprises to multinational giants wants to streamline their budgeting and predict their spending better. But your entire budget plan is hit when an expensive equipment requirement suddenly shows up. There’s also a high likelihood of limiting the growth potential of your business.

Since leasing usually doesn’t require significant capital initially, you can set aside cash for critical processes.

Dropping a few thousand on equipment isn't exactly pocket change, so stretched payment plans are a lifesaver.

Then, you have to factor in maintenance costs down the road. All these combined make leasing more tempting.

2. It lets you update your assets as required

Old stuff slows you down. With newer, more capable equipment, your productivity soars (and profits climb, too!).

For instance, to help you keep your competitive edge, you can lease the servers in your data center and acquire a new one every three years rather than purchasing a server to use for five years straight.

New tech isn't just shiny–it saves you money on running costs and lets you do more in less time.

It is also likely to meet the latest safety regulations, keep your employees safe, and keep your company's reputation sparkling.

Moreover, if a company wants to rent or lease IT equipment, it can usually negotiate the length of its contract. This is especially helpful for companies that may not know precisely when they’ll need all of this IT hardware or peripherals yet but want to make sure it’s available when needed. Leasing agreements often include options to upgrade to newer technology at the end of the lease term.

3. Keeps the security of your assets flexible

Purchasing equipment with a large-scale loan involves a General Security Agreement (GSA)—a legally binding agreement between your company and the bank. It grants the bank a security interest in most of the company's assets, including things it already owns and will acquire in the future.

GSA is like collateral–if you can't repay a loan, the bank can seize and sell those assets to recoup their money.

Banks are also subject to various covenants and reporting obligations as part of financing. Because of this entitlement, the underlying cost to the business is tough to measure.

Leasing firms, on the other hand, obtain a PPSR security interest on the particular assets they finance. This guarantees that you won't be hit with an All PaaPs fee.

4. Avoids end-of-term ownership obligations

Leasing can save you from burdensome long-term ownership obligations and expenses, especially when disposing of outdated assets following legal requirements. A lessor, for instance, can help with the costs associated with remarketing, wiping, packing, transporting, and onsite deactivation. This saves your organization money and effort.

5. Brings more efficiency

Leasing directly affects efficiency, especially for remote teams. It gives you access to the latest technology without the substantial upfront costs of purchasing.

This flexibility lets you quickly equip remote teams with the necessary assets. With the included maintenance and support services during the period, leasing reduces downtime and ensures that your remote teams rely on well-functioning equipment. Onboarding and offboarding also become more streamlined–employees get their equipment on time, are already set up, and are ready to go on day one.

Moreover, monthly payments are predictable, allowing you to manage cash flow even better.

Cons of Leasing

Ingemar Lanevi, LeaseAccelerator’s VP and GM of Global Sourcing Solutions highlights in an interview how multiple departments within an organization have multiple lease agreements, which makes it difficult to determine how profitable leases actually are.

Speaking about the GAAP lease accounting standard ASC 842, which requires leases of more than 12 months to be documented in balance sheets, he says,

“Much as companies struggle to get a true picture of their extended workforce, they also struggle to maintain visibility into all the assets being used to run the business…Many are discovering that the actual economics of their lease portfolios are not as strong as they might have expected.

Another big area of spend leakage relates to managing the end-of-lease contract terms. At the end of an equipment lease…many companies…do nothing. The result is the lease contract effectively auto-renews at the original rent and the customer continues to pay — sometimes for several years.”

Here are a few more of the downsides that come with leasing:

1. You do not own the equipment

Leasing means the equipment belongs to you only for the duration of the contract. It’s ultimately the property of the leasing company, and you must return it once the lease period expires. You cannot resell or repurpose it.

Moreover, based on your lease agreement, this also indicates a dependency on the lessor for repair or support. Subpar lessors can make the leasing experience regrettable.

2. It may prove more costly in the long run

Leasing contracts may prove to be more costly in the long run. By the end of the contract period, you may have given away much more than the cost of the original equipment. This is because you're paying for the equipment's depreciation and the leasing company's profit margin.

Moreover, as Lanevi mentions, [some] “leasing companies have a reputation for using predatory contract terms that force customers to pay excessive fees at the end of the lease”.

3. Contract binds you to pay for the entire lease term

You cannot stop paying for equipment you leased just because it’s no longer needed. The contract binds you to pay for the entire term of the agreement, and this could mean paying for equipment even if it collects dust.

Some contracts may have a predefined notice period before you can voluntarily terminate them. Provide proper notice to avoid attracting a penalty. Moreover, unlike bought assets, you cannot sell leased equipment, which means restricted flexibility in managing the equipment.

4. Lack of advanced customization

You must typically choose from standard configurations offered by the lessor, which may not fully align with your unique operational needs or specialized workflows. This limitation can be critical for industries or businesses relying on customized hardware setups and necessitates compromising certain features or functionalities.

What Does It Mean To Buy Equipment

Unlike leasing, buying equipment simply means taking complete ownership of equipment with a fixed initial payment (and sometimes) against a loan. Let’s evaluate the pros and cons of buying equipment.

Pros of Buying

A Redditor H2OZDrone writes about why they prefer buying equipment over leasing:

Many businesses need full ownership of the equipment needed for their operation, be it for security considerations or internal policies. Here’s why buying equipment makes sense under the right circumstances:

1. Offers complete ownership

When you buy equipment, you own it outright. This means you have complete control over its use and maintenance, and you can even sell it eventually. Unlike leasing contracts, there are zero restrictions imposed on the equipment that you purchase.

Purchased equipment counts as an asset on your balance sheet; this positively impacts your company’s financial position. The proof of tangible assets comes in handy when you go out to seek loans or attract investors later on.

2. Proves to be more cost-effective

First, the lifetime cost of owning equipment is usually cheaper than leasing.

Yes, leasing does have lower initial costs, but the cumulative payments over time exceed the purchase price if you are on a lengthy lease agreement. Life cycle costing helps calculate the total cost of ownership; it often proves that buying is more economical in the long run.

Then there are tax benefits. Under Section 179 of the U.S. Internal Revenue Code, businesses can deduct the full purchase price of qualifying equipment in the year it is placed into service. For 2024, the maximum deduction is $1,220,000. This is a significant reduction in taxable income and provides immediate tax relief.

3. Lets you sell at will

Purchased equipment gets depreciated over its useful life. However, this depreciation brings an annual tax deduction, which helps offset the initial purchase cost over time. For instance, if your business purchases machinery for $100,000 and it has a useful life of 10 years, using the straight-line method, you can deduct $10,000 annually from its taxable income.

Moreover, resale value is something you consider while buying equipment. When you purchase equipment, you always have the option to sell it once it no longer serves you. You recoup some of the initial investment, which further reduces the overall cost of ownership.

4. Brings operational flexibility

Owning equipment means you have no restrictions on how you can use it. You can modify or upgrade it as needed without permission from a leasing company.

You also enjoy freedom from contractual obligations. Buying eliminates the need to adhere to lease terms and conditions, such as usage limits or penalties for early termination, allowing you greater operational flexibility and freedom.

5. It gives you the option to finance your equipment purchase

Finally, an equipment loan might solve the dilemma if you need help with equipment leasing and buying outright due to cash constraints. Like leasing, an equipment loan lets you purchase the necessary assets without draining your cash flow.

Even if you don’t qualify for a low-interest equipment loan, you'll find other options in your toolbox. Cash flow loans, merchant cash advances, or invoice financing will help you cover costs. For smaller equipment, even a business credit card will do the trick.

Cons of Buying

1. Has a higher initial investment

Buying equipment involves a much higher cost, especially if you have a high headcount. This can strain cash flow, particularly for small businesses or startups with limited capital.

Moreover, large expenditures on equipment may restrict funds available for other critical business areas such as marketing, hiring, or expansion.

2. Complete responsibility for maintenance and upkeep

It’s your machine, and you have to oil it. While some leasing companies offer services for upkeep and maintenance, buying doesn’t give you that leeway. You are responsible for all maintenance and repair work your equipment needs. Keep in mind that equipment breakdown can lead to downtime or operational hurdles. Moreover, maintenance may require specialized skills or resources that your team may not possess, which may require further costs.

3. There’s a risk of obsolescence.

Purchased equipment may need to be updated with rapid technological changes. That’s why it’s important to evaluate your purchase so you buy equipment carefully that you’re sure will suffice for at least the next 4-5 years.

4. Presents storage and disposal challenges

Unlike leased equipment, you need physical storage space and a proper disposal plan once your purchased equipment ends its life. Responsibly disposing of outdated equipment can be a tough job and may involve costs for recycling or environmental compliance. Further, improper IT asset disposal practices can also pose environmental or data breach risks.

Our VP of operations, Yona says that 'With the ability to offboard users and reuse equipment, the ROI of buying usually makes more sense when you have enough capital to invest, both from a financial perspective (i.e. IT Equipment have an average duration of 3-5 years, when leasing already covers the full cost of equipment after 2-3 years) and CO2 Emissions (i.e. reusing equipment for multiple employees decreases your company CO2 emissions).

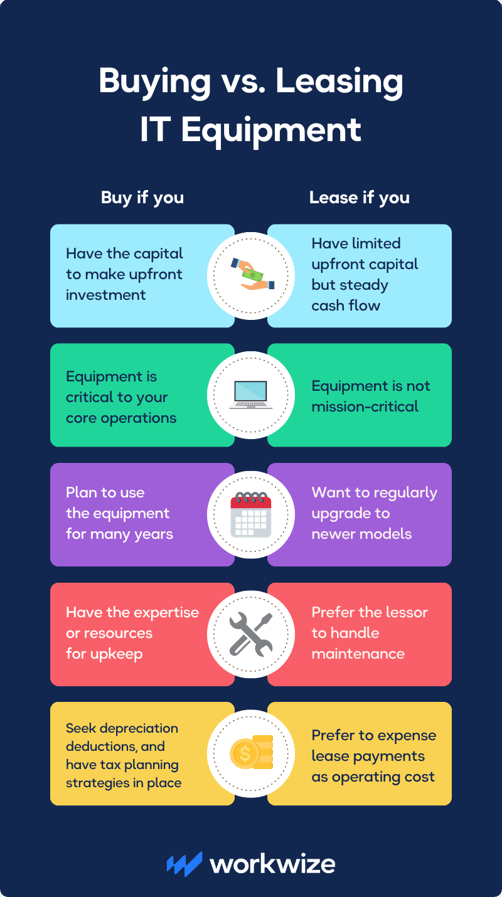

Making The Decision: Buying vs. Leasing Equipment

A Redditor sums up the buy vs. lease debate in a much-appreciated post:

Indeed, the first step to deciding whether to buy or lease is to examine your finances. Lease if you’re an SMB; buy if you’re a mature organization with decent cash flow.

However, there are specific other tips to help you arrive at a suitable decision:

-

What you intend to do with your equipment: You’re better off buying equipment you intend to use for the long term (say 5-6), whereas it’s always more sensible to rent/lease equipment for short intervals or one-off needs.

-

Tax implications: Discuss with your accountant if CapEx or OpEx would offer you better tax benefits, and choose either option based on some of the other points we made

-

Preparedness for maintenance: It’s better to lease highly specialized equipment that can be hard to maintain and repair. On the other hand, if you are a large enterprise with enough budget and manpower, buying is always a more worthy alternative.

Also read: 12 Best Laptops for Remote Work and Distributed Teams

Buy vs. Lease summed up.

Looking To Rent, Buy, or Lease? Workwize Is All You Need!

We just reviewed everything you need to know about leasing vs. buying IT equipment. Your final decision to buy or rent depends on your assessment of your unique business needs.

No matter what choice you make, Workwize has your back.

With Workwize, you can rent, lease, or buy MDM-enabled (Apple Business Manager, Windows Autopilot) and pre-configured IT equipment, peripherals, or company swag for your global workforce in over 100 countries.

With Workwize, you can manage all your equipment in one consolidated view. Forget disappointing contracts and hidden fees. Enjoy complete flexibility in procuring equipment with fast shipments and easy customizations.

Book a demo now to see how Workwize can help you buy, rent, or lease without the fuss of traditional methods.

About the authors:

Simplify IT operations with Workwize

Learn how Workwize makes IT asset management easier and more efficient. Schedule a custom demo today and see the difference.

Recent articles

PC as a Service (PCaaS): Definition and Benefits for IT Teams

Imagine this: you’re knee-deep in device requests. HR needs laptops for new hires, DevOps is...

Unlock Hidden Value with an IT Asset Buyback Program

Moving on from old hardware is a headache. Unused IT assets occupy space, but that’s the...

Device-as-a-Service: The Ultimate Guide

What if your employees could work with best-in-class devices while your IT and finance teams...

Ready to optimize your remote on- and offboardings?

Let’s schedule a short chat and see how we can help!